Diabetes Ireland has launched its 2022 Pre-budget submission and is proposing 8 immediate actions for implementation which will improve the quality of life for over 225,000 people living with diabetes and reduce the long term costs of preventable diabetes complications. The submission is focused on a range of deliverable actions that are person-centred, cost effective and builds on existing HSE commitments to tackle chronic conditions including diabetes.

One of these Actions is Easier Access to Mortgage Protection Cover

Mortgage Protection Cover for People with Diabetes

Mortgage Protection Cover for People with Diabetes

Diabetes Ireland regularly receive enquiries from people with diabetes in relation to difficulties in accessing mortgage protection and life cover. While the issues faced by people with diabetes pre-covid still remain, unfortunately COVID 19 has made the market even more difficult for people with diabetes seeking to purchase a new home. The issue was recently raised by TDs with the Minister for Finance who agreed to consider the issue.

People with Type 1 diabetes can expect to pay 200-450% more on their mortgage protection cover, depending on their diabetes management, while those with Type 2 diabetes can expect to pay 50-200% more. If it is a joint mortgage, only the person with diabetes will be loaded.

Mortgage protection cover is normally based on a medical examination where individuals are assessed against set criteria and rated accordingly. Diabetes Ireland is seeking a change from the current system where the insurance industry, based on the results of a medical assessment has the final say as to whether they wish to offer mortgage protection to a person being treated with insulin to one where the person has the choice on whether to accept or decline an offer of mortgage protection with premium loadings. At present, they do not have this choice and once declined it is very difficult for that person to obtain mortgage protection.

When an individual informs an insurance underwriter they have diabetes, different insurance companies and brokers will treat that person in different ways. Some will refuse to give a quotation while others may expect the person to undergo a full medical examination with a doctor and/or ask the person’s GP to complete a medical report which the insurance company will pay for and much higher premiums are a given.

It is possible for a person with diabetes to get mortgage protection, but the premiums will depend on a number of factors such as the type of diabetes, the duration of diabetes, recent HbA1c readings, medications, Body Mass Index (are you overweight), if a person has existing diabetes complications and the person is a smoker.

Most people with diabetes who are looking for cover will find that their premiums will be loaded or rated to reflect the level of risk for an insurance provider and in some cases, cover will be declined. People with poor glycaemic management will find it extremely difficult and almost impossible to obtain mortgage protection. A simple measure of this is HbA1c which ideally should be under 53mmol/mol (or 7%). If it is above this, an individual maybe asked to return at a later date when they have improved their HbA1c. An individual may also be refused or delayed cover if some of the other health issues as outlined above are at play.

Although Diabetes Ireland is not happy with the set criteria on which the medical examination and ratings system is based, we are not advocating for change of the criteria. However, we are advocating that every person with diabetes be given the personal choice as to whether they wish to accept or decline an offer of mortgage protection rather than the current system where the insurance company make the choice for them.

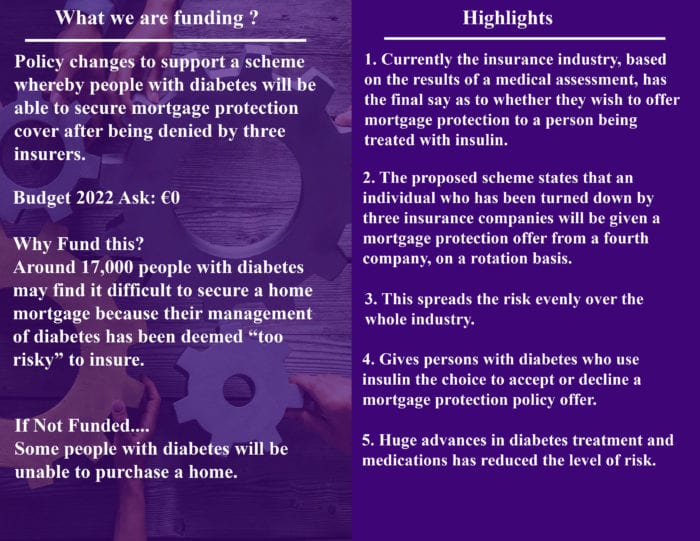

Diabetes Ireland is proposing a scheme for mortgage protection cover whereby a person being treated with insulin who having been turned down for mortgage protection three times by different companies will receive an offer of mortgage protection cover from a fourth company, identified by Insurance Ireland, on a rotation basis.

We fully accept that the insurance industry must look at individual cases from a commercial viewpoint and they see people with type 1 diabetes as a higher risk which could lead to poor claims experiences in some cases. For this reason, at present, underwriters will load the premium or decline the cover for those people.

With the huge advances and improvements in diabetes treatment and medications now available the risk of poor claims experience is much less than it was 5-10 years ago, and the risk will continue to reduce as treatments and medications are continually improved. We now have Continuous and Flash Blood Glucose Monitoring systems which have transformed the management of diabetes compared to 5-10 years ago.

It is well established that optimal blood glucose management reduces the risk of complications and allow people with diabetes to achieve a normal life expectancy free from these complications. The aim of medical treatment of diabetes is to achieve that potential as far as possible without adversely impacting on the quality of life for the person with diabetes and their family. It is our view that the current system for mortgage protection cover is not in line with this sensible approach.

It is estimated that there are currently 225,000 people with diabetes in Ireland and 10%-15% of these are being treated with insulin. Based on age profile, 50% of these, possibly with partners, will be looking for mortgage protection at some time in the future thus giving a market size of approximately 17,000 people with diabetes. This will create extra business for the industry with the minimal risk of poor claims experience evenly spread over the whole industry.

Under our proposed scheme there is no loss of competitive edge as all competitors will have to accept individuals with diabetes on a rotation basis. The benefit of such a scheme to the individual is that they will have a choice on whether to accept or decline an offer of mortgage protection cover. Having the choice will only impact positively on their future lifestyle and home life.

This system aims to be fair to all stakeholders. It looks to ensure that every person with diabetes could buy a home and raise a family in a safe and secure environment. It creates a fair marketplace and gives people with diabetes a choice they do not have at present.

Diabetes Ireland recently met with the Minister of State for Finance, Sean Fleming TD on this issue. After a positive meeting, the Minister agreed to discuss this issue with interested parties and and we await their response.

To read the full Pre Budget Submission, click here.

Please note there are many other important issues we plan to highlight and advocate for implementation and we will be working with all stakeholders to do this in a strategic way going forward.

Our advocacy work is important in giving our diabetes community a voice to be heard, become a member today, click here.

Call to action July 2021